How Many Stocks Should One Hold? 0 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Assuming that the investor is purely equity-focused in his approach, one of the key questions he should ask constantly is: what should be the optimal number of stocks in his portfolio?

This will obviously be a function of the monetary size of the portfolio, the number of investment ideas he has, and his belief and need for diversification. For portfolio size, anything below $50K may not justify diversification, if we consider that a meaningful position should be at least $10K. 5 stocks --- that will be the maximum one should have in his portfolio for that amount. But for higher portfolio sizes, it may then be relevant to start thinking about whether to have many or few stocks in one's portfolio. The number of investment ideas is also a factor, because if one has ten different investment ideas (hot sectors, or stocks) which he considers to be equally good, then the option of investing in all these ten ideas then surfaces; that is what Peter Lynch does (he held thousands of stocks in his Fidelity portfolio); however a more "discerning" investor may only consider a very limited pool of stocks/ideas to be top-of-the-line, and hence his core holdings are much lesser in number (eg. Warren Buffett).

With regard to diversification, it is easy to dismiss it but the logical arguments for it are quite compelling. Those interested can read an earlier writeup on "The case for diversification". The point is that one must know what one is trying to diversify against: market risk, sector-specific risk or company-specific risk? Those arguing for focused stock holdings point out that diversification dilutes returns and is practised by those with little confidence/domain knowledge in their stockpicks; that is borne out by experience apparently. However if we consider the figures below:

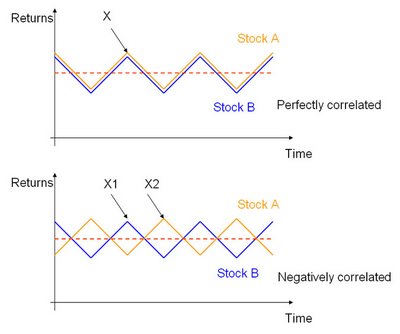

The top graph shows a portfolio with two stocks A and B perfectly correlated with each other ie. their returns at any time over the market cycle are directly related to each other; this could be seen as a focused portfolio with one stock (because A and B are perfectly correlated). The bottom graph is a portfolio where A and B are inversely correlated and therefore offer diversification. The diversification is achieved here because although both portfolios have the same average return, the bottom portfolio eliminates all the variability in the returns. Focused portfolio believers argue that they can achieve better returns because by cashing out at point X on the upper graph, they can achieve double the return. What they ignore is that a diversified portfolio also enables them to achieve a similar performance --- by cashing out at two points: X1 for stock B and X2 for stock A. True, good timing is required for this, but isn't timing required for getting out at point X in the earlier focused portfolio as well?

The limiting factor is really the ability of the individual investor to monitor the various fundamental developments for his stock portfolio. Supposing one has 30 stocks, how is he going to monitor the company and industry developments effectively? The issue here is really one of dilution of attention focus, not of returns.

Personally, I structure my portfolio by sectors into which I populate with stockpicks. Imposing structure on the portfolio is a useful way of allocating resources, much in the way that a company splits into different business/functional divisions ("Your stock portfolio is your company"). Therefore I only need to monitor in detail the few sectors that I invest in, as a proxy to the various stocks in the sector group. The stocks that populate a particular sector/theme are then chosen on certain attributes, such as valuation, a coveted position in the value chain of the chosen sector etc. A few stockpicks within one sector/theme enables company-specific diversification in case one of the companies (touch wood!) suffers a negative corporate development eg. an unexpected receivables writeoff. It also enables corroboration of market outlook on the particular sector through cross-comparisons of price trends of one's various portfolio stockpicks in the particular sector/theme (eg. if one holds Hiap Seng and Rotary in his portfolio on the oil/gas infrastructure theme, the price strength in both stocks will help to corroborate each other's price trends, and the optimism surrounding the sector in general).

That, in essence, is quite similar to how unit trusts structure their portfolio, admittedly. The key point is that structure is important. The difference is in how many stocks we can manage in our portfolio. Again from personal experience, 3-4 sectors/themes are a good rule-of-thumb, and within each sector/theme, about 3-4 stocks would give good exposure and diversification without overly putting pressure on the individual investor's attention focus. Thus a good portfolio, in my view, should consist of anything from 10-15 stocks. By limiting oneself to a certain numerical limit of stocks in his portfolio, it also forces the investor to look and think deeper about potential stockpicks instead of buying on impulse, any stock that comes into market focus on a particular day.

0 Comments:

Post a Comment

<< Home