Amtek's rights issue 10 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Recently Amtek announced that to reward shareholders and to utilise their Section 44 tax credit, they would declare a $0.28 dividend, payable in cash or in scrip. By scrip they mean the issue of a new rights share priced at $0.28 per ordinary share ie. existing shareholders can use their $0.28 entitlement to subscribe to the rights issue.

On first look, it seemed like a great deal; Amtek shares were trading at about $1. But consider: the rights issue if fully subscribed (ie. 100% takeup; nobody opts for the cash dividend) would in no way augment the company's capital (since it would be just left hand to right hand for the company); it would effectively be a 2:1 split or 1:1 bonus issue or whatever way the corporate financiers choose to sugarcoat it. If rights takeup was 100%, the company did not have to pay out a single cent of special dividend in cash.

The offer to the shareholders is structured in such a way that they would find it more to their advantage to opt for the rights shares. Consider the mathematics below:

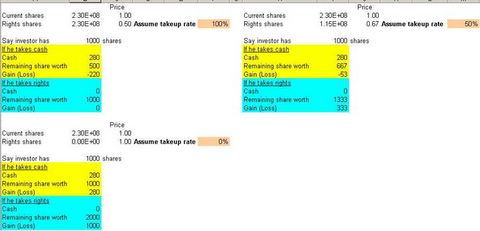

The case for a 100% rights takeup, 50% rights takeup and 0% rights takeup is illustrated (based on convenient share price of $1). For each case, the theoretical gains accruing to the individual for either option he selects (take cash or take rights) is examined (in yellow section, and in blue section respectively). For 100% rights take-up, it is effectively a share split, which means ex-rights share price is halved. If the individual opts for cash dividend of $280 per lot, he ultimately ends up with $780 ($500 for the one lot he continues to hold, plus the $280 cash); a loss of $220! It is better for him to take up the rights; he ends up with no gain, actually. For 0% rights takeup (ie.all investors opt for cash dividend), the individual gains $280 (the cash dividend) plus the one lot which hasn't changed in price (since no dilution); but he would still be better off choosing to double his stock holdings by taking up the rights, since he can make $1000 this way. The 50% take-up is somewhere in between.

It can be seen that in all cases, it makes sense logically for the investor to opt for the rights "dividend". Of course, it makes a big difference to the company which option its shareholders go for: a 0% takeup rate means a big cash drain on the company; a 100% takeup rate means a mere readjustment of figures on the share capital account and a claim that the company has "added value" for its shareholders.

Well, Amtek did make money for the existing shareholders after the special dividend announcement; the share price rose by ~30% from 90 cts to $1.15. To me it was more due to the favourable 4Q results and the euphoria generated by the "$0.28 special dividend" than any real substance in the "payout". Of course, Amtek remains a good company, as the leading precision engineering company in Singapore; however the recent exercise hardly brings any value to shareholders, in my view.

10 Comments:

The exercise could be initiated to tap their S44 credits which isnt bad afterall.

The exercise could be initiated to tap their S44 credits which isnt bad afterall.

Hello DanielXX, been looking for the latest info on discounted notes and found Amtek's rights issue. Though not exactly what I was searching for, it did get my attention. Interesting post, thanks for a great read.

Hello DanielXX, been looking for the latest info on business notes and found Amtek's rights issue. Though not exactly what I was searching for, it did get my attention. Interesting post, thanks for a great read.

Yes, the exercise was to utilise their S44 tax credit. But basically the tax credit was utilised but to no real tangible benefit, that's my point.

Definitely one of the most insightful blogs here! This site has helped many people looking for: estate investing real No more wondering estate investing real

Interesting site, DanielXX. I have been reserching for forex auto-trade related information on the internet when I stumbled upon your blog. While surfing I came across one other terrific forex auto-trade related site. Check it out. You may find it useful.

Best of luck.

I am 7 mth late but wish to add that the exercise adds value by way of facilitating tax benefit claims by small investors from the government under sec 44. It also shows that the big inside guys care, eventhough they would likely not benefit directly. It wins my vote although i have not made $$$ from this investment ..... which should come one day.

Yes, it did utilise the company's Section 44 credit. Well looking at Amtek's cash position it was not in a position to pay cash anyway. I might have been too harsh, on retrospect; it is not a bad company.

Great post about amtek.

Post a Comment

<< Home